About

Home - About

Growth Rate

Taxation is a term for when a taxing authority, usually a government, levies or imposes a financial obligation on its citizens or residents. Paying taxes to governments or officials has been a mainstay of civilization since ancient times.

The term “taxation” applies to all types of mandatory levies, from income to capital gains to estate taxes. Though taxation can be a noun or verb, it is usually referred to as an act; the resulting revenue is usually called “taxes.”

Key Takeaways

- Taxation occurs when a government or other authority requires that a fee be paid by citizens and corporations, to that authority.

- The fee is involuntary, and as opposed to other payments, not linked to any specific services that have been or will be provided.

- Tax occurs on physical assets, including property and transactions, such as a sale of stock, or a home.

- Types of taxes include income, corporate, capital gains, property, inheritance, and sales.

GDP GROWTH RATE

The growth rate in Real GDP during 2024-25 is estimated at 6.4% as compared to 8.2% in 2023-24. Nominal GDP or GDP at Current Prices is estimated to attain a level of ₹324.11 lakh crore in the year 2024-25, against ₹295.36 lakh crore in 2023-24, showing a growth rate of 9.7%

Gross domestic product (GDP) is the total monetary or market value of all the finished goods and services produced within a country’s borders in a specific time period. As a broad measure of overall domestic production, it functions as a comprehensive scorecard of a given country’s economic health.

Though GDP is typically calculated on an annual basis, it is sometimes calculated on a quarterly basis as well. In the United States, for example, the government releases an annualized GDP estimate for each fiscal quarter and for the calendar year. The individual data sets included in this report are given in real terms, so the data is adjusted for price changes and is, therefore, net of inflation.

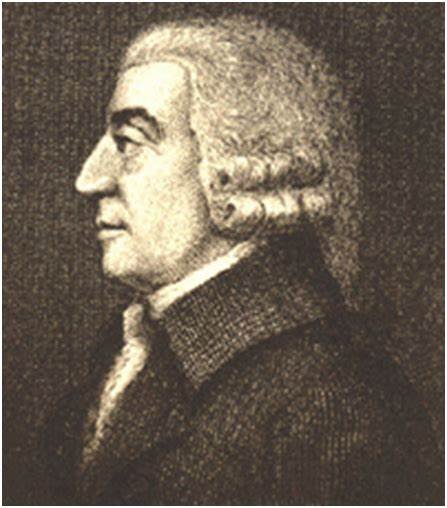

Biography

The recorded history of Smith's life begins at his baptism on June 5, 1723, in Kirkcaldy, Scotland. His exact birthdate is undocumented, but he was raised by his mother, Margaret Douglas, after the death of his father, Adam Smith. He attended the University of Glasgow at the age of 13 and attended Balliol College at Oxford University, where he studied European literature.

After returning to Scotland, Smith held a series of public lectures at the University of Edinburgh. The success of his lecture series helped him earn a professorship at Glasgow University in 1751. He eventually earned the position of Chair of Logic in 1751 and then Chair of Moral Philosophy in 1752. During his years spent teaching and working at Glasgow, Smith worked on getting some of his lectures published. His book, "The Theory of Moral Sentiments", was eventually published in 1759.

Smith moved to France in 1763 to accept a more remunerative position as a personal tutor to the stepson of Charles Townshend, an amateur economist and the future Chancellor of the Exchequer.3 During his time in France, Smith counted as his contemporaries Benjamin Franklin and the philosophers David Hume and Voltaire.